Fuel Retailers Make Shocking Petrol Profit, says RAC.

Retailers are continuing to put up fuel prices when they should reduce them in line with savings in wholesale oil prices, the RAC motoring services organisation has claimed. In response to concerns about the Omicron variant, oil prices fell by around $10 a barrel last week.

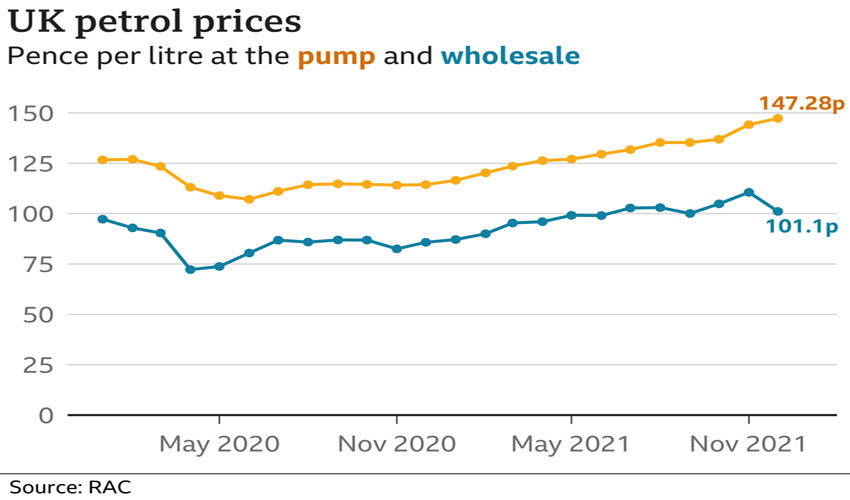

But this reduced wholesale fuel price has not been reflected at the pumps. Retailers added on average another 3.1p to a litre of unleaded petrol and 2.7p to diesel in November.

The RAC said this hike in petrol prices was “completely unjustified”, with larger retailers making a “shocking” profit.

In particular, the RAC pointed the finger at supermarket chains that are major fuel retailers, such as Asda, Sainsbury’s, Tesco and Morrisons, saying they should have reduced prices, but had instead increased them “unnecessarily”.

“Since Covid they’ve been far more reluctant to pass on any savings, even though the frequency with which they buy means they are in a position to pass on any savings in the wholesale price to drivers far more quickly,” RAC fuel spokesperson Simon Williams told the BBC. “It would be much fairer if retailers mirrored wholesale prices more closely on a daily or weekly basis.”

A spokesperson from the British Retail Consortium said: “Supermarkets are keen to provide their customers with the best value for petrol through their forecourts, offering the cheapest petrol in the country. However, prices at the pump will be influenced by various forces, including tax, oil prices and operational costs.”

The RAC has urged the government to intervene and said the chancellor’s fuel duty freeze last month is not enough.

“The government should ask the biggest retailers to explain why they’re charging such high prices for fuel when wholesale prices have dropped,” Mr Williams added.

A government spokesperson said: “Fuel prices are increasing in countries across the world and this is not an issue unique to the UK. “We’ve provided £4.2bn of support to help people with the cost of living, including effectively cutting taxes for workers on Universal Credit, providing £500m of targeted support for the most vulnerable families and freezing fuel duty for the twelfth year in a row.”

Analysis by the RAC found that despite wholesale costs having fallen by 7p from the middle of the month, retailers continued to put prices up, with the average cost of a litre of unleaded petrol ending the month at 147.28p and diesel up to 150.64p.

Prices for both fuels peaked at record highs on 20 November and 21 November respectively – diesel reaching 151.1p per litre and petrol at 147.72p.

The key factor affecting petrol is the wholesale oil market, meaning any reduction in the oil price should result in buyers paying less at the pumps.

While the price of petrol is linked to the wholesale price of oil, it is competitively driven. That means the cost motorists are charged is not directly linked to crude. Instead, suppliers control the prices they sell petrol at.

Mr Williams explained that the current margins big retailers are making have gone up as high as 20p a litre, which is “unheard of when everyone is driving”.

“Sadly, our data shows all too clearly that drivers are being taken for a ride by retailers at the moment,” he said.

However, on Tuesday, motoring group the AA said that the UK’s average petrol prices did begin to show the first “significant fall” since November 2020. Having peaked above 54.5p a litre in the second week of November, the petrol cost to retailers was down to 49p at the start of last week and yesterday dropped below 43p a litre.

But the RAC said it was not enough of a fall to reflect the plummet in wholesale prices.

The AA welcomed the consumer petrol price fall, but criticised the fact it had taken so much longer to drop in relation to falling wholesale prices.

Luke Bosdet, the AA’s fuel price spokesman said that previously, the market would “wait until Asda or Morrisons announced a price cut before starting to move. Without that initial kick, pump prices have stagnated, and that is a potentially worrying development if it sets the pattern for the future,” he said.

“In basic pounds, shillings and pence, if a supermarket makes a big deal about discounts of £2 or £3 off the shopping bill, but grabs back £2 to £3 per tank by not passing on savings at the pump, the consumer needs to factor that in.”